Taxes To Consider

FRENCH TAXES TO CONSIDER WHEN PURCHASING REAL ESTATE IN PARIS

Paris Buyer is the only real estate agent in Paris who is also a fully licensed French mortgage and insurance broker.

This puts us in a very unique position to help you understand the financial reality of owning a home in another country. Clients often tell us “I don't know which questions to ask and I'm afraid of missing something critical.” We are here to demystify the process for you and provide a step by step checklist of points to consider so you can avoid expensive surprises.

CONTACT US

The following is an overview of real estate related taxes in Paris which can frequently change. For specific, up to date advice for your individual situation, it's imperative to consult with a licensed tax expert like a French Notaire or a tax lawyer.

Property taxes: As a property owner in Paris, you'll be required to pay annual property taxes consisting of two main components: the taxe foncière and the taxe d'habitation. Despite the increase in 2023, they are considerably lower than in many other countries.

The taxe foncière is a calculated based on the theoretical rental value of the property and local municipal charges, not market value. This tax is collected annually and is due in October. If you are the owner on January 1, you are liable to pay the taxe foncière for the entire year, even if you sell the property during the year. You will be reimbursed pro rata at time of sale.

The taxe d'habitation, due in November, is also based mainly on the rental value of the property - therefore size and location and also household income. It's payable by the person occupying the property – the owner or tenant with a lease of 1 year or more.

As of 2023, this tax only applies to secondary residences.

The first paper bill will arrive at your French address by the post the year after your purchase. After that, you need to set up a monthly direct debit payment from your French bank account so you don't miss the post and forget to pay. Please make note of this, clients often forget.

Income tax - “IR” or “impot sur le revenu”: This tax would be due on any rental income collected in France for renting the apartment. The taxable rental revenue can be reduced by interest paid on a French mortgage, value improving renovations and management fees. Other deductions may apply based on the tax status you choose. The tax rate depends on your global revenue but should be less than 25% in most cases. Social security tax is also applied to the rental income (tax rate + 17.20%).

Property wealth tax - “IFI” or “impot de solidarité sur la fortune immobilière”: This tax is calculated on the total fair market value of all your real estate assets owned in France less any French loans outstanding on the property. Therefore taking a French mortgage can help you reduce or avoid this tax. If you are a French resident, the “IFI” will be computed on your worldwide real estate properties. If you are a not a permanent resident in France (for tax purposes), it's only calculated on the assets you have in France. Note that interest only mortgages do not qualify for full deductibility but will be treated much like amortizing loan interest for the IFI tax calculation.

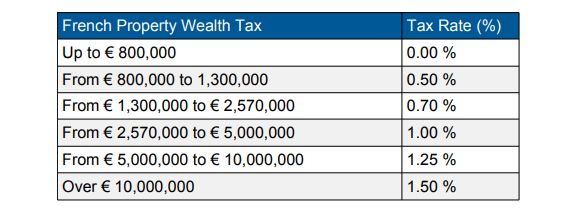

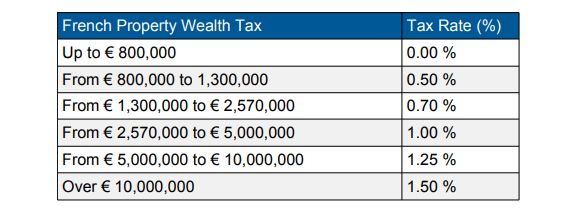

As an indication, the current “IFI” wealth tax rates on your total net asset value are:

Note that the wealth tax is only triggered when you own more than 1.3 million € net of debt.

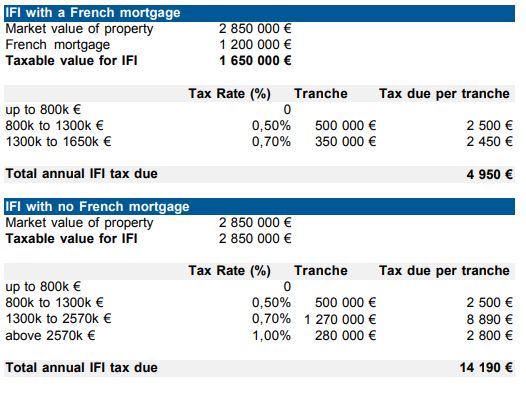

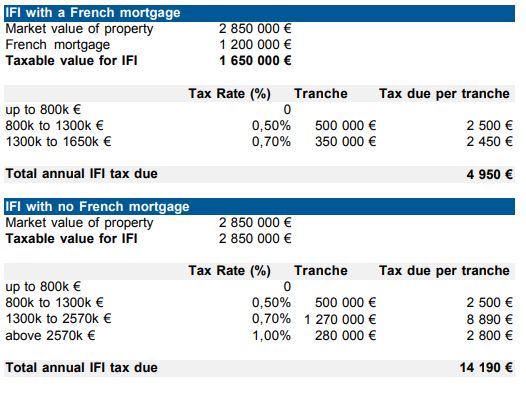

CASE STUDY : You purchase a property worth 2,850,000 € with French mortgage of 1 200,000 €. How much IFI tax will be due?

Capital gains tax or “impôt sur la plus value”: This tax is payable on the difference of your purchase price less your sale price and certain eligible expenses. For a property that is not your main residence, capital gains tax after a sale starts at approximately 36.20% (19% of income tax and 17.20% of social charges) and is progressively reduced each year starting after 6 years to arrive at 0% after 30 years. Therefore if you hold your property long enough, you won’t pay any capital gains tax at sale. There is no capital gains tax on your primary residence, assuming you are a French tax resident.

For all types of properties, except buildable land, the capital gain is totally exempt:

• from the income tax: after 22 years of ownership,

• from the social charges: after 30 years of ownership.

Inheritance tax or “droits de succession”: This is a tax on gifts and inheritances to be paid by each beneficiary. The tax applied is based on a rising scale and depends on the amount inherited/gifted and their relationship to the deceased/donor. This tax applies for both French residents and non residents, when the asset being gifted or bequeathed is located in France.

The above information has been validated by our French notaire partner at time of publication. Tax laws can change at any time. Paris Buyer is not qualified to provide fiscal or legal advice. Always consult a French notaire or tax lawyer for advice tailored to your personal situation.

CONTACT US

What is a French Notaire?

The Notaire is the most qualified professional of the French legal system. The Notaire is both a Public Official and counsel. These qualifications allow him or her to efficiently advise clients in real estate law, family law, inheritance and corporate law. They are bound by very strict laws to give up to date, correct and unbiased advice.

The French State gives the Notaire the power to legalize certain agreements such as real estate sales which cannot be enforced by any other means. This monopoly prevents almost any subsequent litigation. However, the Notaire does not only draft and authenticate deeds. As today's legal transactions are more and more complex, counseling clients is also a major function of a modern Notaire.

LAUNCH YOUR PARIS APARTMENT SEARCH

Whether you are a non-resident or full time French resident, these French taxes must be paid on your Paris apartment:

- Annual property taxes: local real estate taxes called “taxe fonciere” and “taxe d’habitation”

- Annual income tax: due on any income derived from activities in France such as renting your property

- Annual property wealth tax: called “impôt sur la fortune immobilière (IFI)”, this tax is due on French property assets valued at more than 1.3 million € net of debt

- Capital gains tax: payable on the difference of your purchase price less your sale price and certain eligible expenses

- Inheritance tax: payable by your heirs in the event of death

| TOP TIP – The last three taxes can be minimized with proper planning so require careful consideration from a French tax expert. Tax treaties between France and your home country may also apply. |

CONTACT US

The following is an overview of real estate related taxes in Paris which can frequently change. For specific, up to date advice for your individual situation, it's imperative to consult with a licensed tax expert like a French Notaire or a tax lawyer.

Property taxes: As a property owner in Paris, you'll be required to pay annual property taxes consisting of two main components: the taxe foncière and the taxe d'habitation. Despite the increase in 2023, they are considerably lower than in many other countries.

The taxe foncière is a calculated based on the theoretical rental value of the property and local municipal charges, not market value. This tax is collected annually and is due in October. If you are the owner on January 1, you are liable to pay the taxe foncière for the entire year, even if you sell the property during the year. You will be reimbursed pro rata at time of sale.

The taxe d'habitation, due in November, is also based mainly on the rental value of the property - therefore size and location and also household income. It's payable by the person occupying the property – the owner or tenant with a lease of 1 year or more.

As of 2023, this tax only applies to secondary residences.

The first paper bill will arrive at your French address by the post the year after your purchase. After that, you need to set up a monthly direct debit payment from your French bank account so you don't miss the post and forget to pay. Please make note of this, clients often forget.

Income tax - “IR” or “impot sur le revenu”: This tax would be due on any rental income collected in France for renting the apartment. The taxable rental revenue can be reduced by interest paid on a French mortgage, value improving renovations and management fees. Other deductions may apply based on the tax status you choose. The tax rate depends on your global revenue but should be less than 25% in most cases. Social security tax is also applied to the rental income (tax rate + 17.20%).

Property wealth tax - “IFI” or “impot de solidarité sur la fortune immobilière”: This tax is calculated on the total fair market value of all your real estate assets owned in France less any French loans outstanding on the property. Therefore taking a French mortgage can help you reduce or avoid this tax. If you are a French resident, the “IFI” will be computed on your worldwide real estate properties. If you are a not a permanent resident in France (for tax purposes), it's only calculated on the assets you have in France. Note that interest only mortgages do not qualify for full deductibility but will be treated much like amortizing loan interest for the IFI tax calculation.

| TOP TIP – A French mortgage can be a very cost effective way to reduce annual IFI and enable higher returns on your cash investments elsewhere. |

As an indication, the current “IFI” wealth tax rates on your total net asset value are:

Note that the wealth tax is only triggered when you own more than 1.3 million € net of debt.

CASE STUDY : You purchase a property worth 2,850,000 € with French mortgage of 1 200,000 €. How much IFI tax will be due?

Capital gains tax or “impôt sur la plus value”: This tax is payable on the difference of your purchase price less your sale price and certain eligible expenses. For a property that is not your main residence, capital gains tax after a sale starts at approximately 36.20% (19% of income tax and 17.20% of social charges) and is progressively reduced each year starting after 6 years to arrive at 0% after 30 years. Therefore if you hold your property long enough, you won’t pay any capital gains tax at sale. There is no capital gains tax on your primary residence, assuming you are a French tax resident.

For all types of properties, except buildable land, the capital gain is totally exempt:

• from the income tax: after 22 years of ownership,

• from the social charges: after 30 years of ownership.

| TOP TIP – If you do a major renovation, be sure to obtain official invoices for all services and materials, clearly stating the registered French company details and value added tax. Organise them immediately after you finish and save them along with all of your other property purchase documents. This can significantly reduce your capital gains later when you sell. |

Inheritance tax or “droits de succession”: This is a tax on gifts and inheritances to be paid by each beneficiary. The tax applied is based on a rising scale and depends on the amount inherited/gifted and their relationship to the deceased/donor. This tax applies for both French residents and non residents, when the asset being gifted or bequeathed is located in France.

| TOP TIP – Inheritance tax is a complicated and potentially expensive subject and requires the expert advice of a French Notaire. Contact us to be put in contact with one of our trusted partners. |

The above information has been validated by our French notaire partner at time of publication. Tax laws can change at any time. Paris Buyer is not qualified to provide fiscal or legal advice. Always consult a French notaire or tax lawyer for advice tailored to your personal situation.

CONTACT US

What is a French Notaire?

The Notaire is the most qualified professional of the French legal system. The Notaire is both a Public Official and counsel. These qualifications allow him or her to efficiently advise clients in real estate law, family law, inheritance and corporate law. They are bound by very strict laws to give up to date, correct and unbiased advice.

The French State gives the Notaire the power to legalize certain agreements such as real estate sales which cannot be enforced by any other means. This monopoly prevents almost any subsequent litigation. However, the Notaire does not only draft and authenticate deeds. As today's legal transactions are more and more complex, counseling clients is also a major function of a modern Notaire.

Paris Perfect Buyers

9, rue Jacques Cœur

75004 Paris

75004 Paris